At that factor, the car can not be driven or parked anywhere in the state till you have ourchased insurance coverage for it. When Should I Obtain Automobile Insurance in The Golden State?

Driving without the minimum necessary insurance coverage is prohibited, and you can obtain a ticket. If you do not have insurance, your registration will certainly be suspended - affordable auto insurance.

insurance business insurance auto insure

insurance business insurance auto insure

car insurance car insurance prices auto

car insurance car insurance prices auto

Is Liability Insurance Policy Required in California? Obligation insurance covers accidents where you are at fault (cheaper). Does California Accept Digital Insurance Policy Cards?

The prices revealed right here are for relative functions just as well as should not be thought about "ordinary" rates offered by private insurance providers. Since vehicle insurance coverage rates are based upon individual aspects, your automobile insurance coverage prices will vary from the rates shown right here. United State Information 360 Testimonials takes an objective method to our referrals. laws.

auto suvs low cost risks

auto suvs low cost risks

The ordinary automobile insurance policy expense in California can range from $733 for very little insurance coverage to $2,065 for full coverage (cheapest car insurance). Obtaining a specific solution is difficult without addressing a great deal of concerns like where you live, and also your auto model, amongst others. dui. Despite all of that, understanding the ordinary price goes to least an excellent beginning point in establishing what you may have to invest.

With that in mind, we'll review the ordinary expense of auto insurance in The golden state. insurance affordable. After that we'll dig much deeper to discover just how you can optimize your cost savings while getting the insurance coverage you require. The Aspects that Impact Average Car Insurance Policy Prices in The golden state It's probably not a surprise to find that not every person pays the same prices for auto insurance in California.

Not known Incorrect Statements About Minority Neighborhoods Pay Higher Car Insurance Premiums ...

Regarding the insurance companies are concerned, the best are vehicle drivers that are forecasted to have the fewest insurance claims. That means they drive securely and responsibly. On the various other hand, higher-risk customers are those that could be likely to kip down more claims and also create the insurance company even more money. The insurance companies take a look at teams of individuals to figure danger based upon how others in the exact same group typically behave.

Young guys will generally be billed extra for their car insurance policy than those that are older or woman. Age, sex, and marital standing are considered here.

And also married individuals are commonly more secure vehicle drivers than solitary individuals. Some are extremely pricey to fix, so insurers charge extra for coverage.

How do you utilize your auto? If you commute daily for lengthy distances, you can most likely anticipate to pay more for your policy than if you only put a couple of thousand miles a year on the odometer (auto). It may not appear reasonable, however you're most likely to pay even more for your protection if you have a bad credit report.

You can likewise choose to take just very little protection as mandated by your state. That would be obligation protection, which we'll clarify later on. insured car. Average Annual Auto Insurance Coverage Expense in The golden state As you can see, there are a great deal of aspects that will influence the expense of car insurance policy in California for you.

Complete insurance coverage: $2,065 Very little coverage: $733 What Marginal and Full Insurance Coverage Insurance Method The finest description of those terms is that full insurance coverage uses the finest monetary protection. Minimum protection provides the least expensive level of vehicle insurance coverage that each state will enable a chauffeur to have.

The Best Strategy To Use For Automobile Insurance Information Guide

This is called obligation insurance coverage. If you were responsible for a crash that harmed another motorist and harmed an automobile, your insurance coverage would certainly compensate to a specific buck amount for the injury and damages to the other vehicle (trucks). You would not be able to transform in a case for the damage to your very own vehicle - credit.

Driving an automobile means having automobile insurance coverage, due to the fact that in California it's a requirement. California does not play games when it concerns driving as well as staying insured (cheap). There are lots of auto insurance policy providers supplying great deals of different choices that fulfill or surpass the state requirements because there are numerous vehicle drivers to insure.

Ordinary Price for Minimum Car Insurance Demands in California, The golden state, like nearly all various other states, has actually developed state laws that mandate vehicle proprietors need to have a certain level of car insurance policy protection (insurance companies). If you're driving in California, you are lawfully called for to have insurance as well as the plan information need to remain in the car with you.

Value, Penguin has the highest possible yearly average of $617 for minimal coverage. Given that data, it's secure to state automobile insurance will certainly set you back around $550 a year Have a peek here or more if you decide for extra coverage.

risks affordable car insurance insurance affordable liability

risks affordable car insurance insurance affordable liability

Typical The Golden State Automobile Insurance Coverage Expenses Past the Minimum, If you live in California you won't be as well surprised to locate that the yearly price of car insurance policy is 20% greater usually compared to various other states. That's considering all 27 million The golden state vehicle drivers, numerous of which pick to obtain automobile insurance protection past the minimum required quantities.

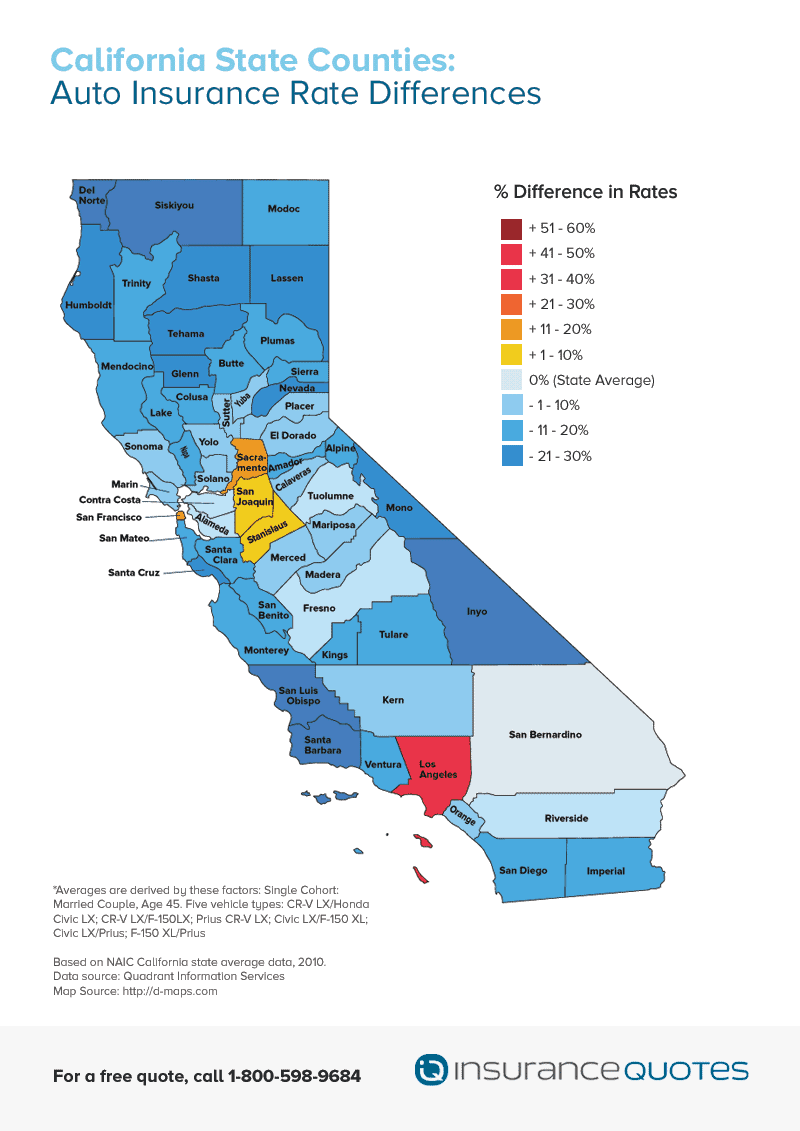

55. The Zebra estimates the average yearly costs for The golden state vehicle insurance is $1,713 a year (vehicle). There's a broad spread between the standards for great reason. A great deal of elements go right into the cost of an automobile insurance premium - cheaper car insurance. Companies are considering your age, marriage condition, place and also driving document before they offer you a quote.