cheap car insurance cheap insurance prices insurance

cheap car insurance cheap insurance prices insurance

Insurance service providers wish to see demonstrated accountable habits, which is why traffic crashes and also citations are factors in figuring out cars and truck insurance prices. Remember that aims on your license don't stay there forever, yet the length of time they remain on your driving document differs depending on the state you stay in and the seriousness of the infraction.

As an example, a brand-new sporting activities car will likely be more expensive than, say, a five-year-old sedan. If you pick a lower insurance deductible, it will lead to a greater insurance policy costs which makes selecting a greater deductible seem like a respectable bargain. A higher deductible might suggest paying even more out of pocket in the event of a crash.

What is the typical car insurance coverage expense? There are a variety of aspects that affect just how much car insurance coverage expenses, which makes it hard to obtain an exact suggestion of what the average individual spends for automobile insurance. According to the American Auto Association (AAA), the typical cost to guarantee a car in 2016 was $1222 a year, or roughly $102 each month.

Nationwide not just offers competitive prices, but also a variety of discounts to aid our members conserve even a lot more. How do I obtain cars and truck insurance policy? Obtaining a vehicle insurance coverage price quote from Nationwide has actually never ever been less complicated. See our vehicle insurance policy quote area and enter your zip code to start the car insurance coverage quote process. cars.

Likewise, if you have a background of having car insurance coverage policies without submitting cases, you'll get less expensive prices than someone that has actually submitted cases in the past.: Automobiles that are driven much less frequently are much less most likely to be associated with an accident or various other destructive occasion. Cars with reduced yearly mileage might certify for somewhat lower rates.

3 Things To Consider When Buying Car Insurance For A Pre ... Things To Know Before You Get This

To discover the best car insurance policy for you, you should comparison shop online or talk to an insurance agent or broker. You can, but be certain to track the insurance coverages picked by you and also supplied by insurance providers to make a fair comparison. Conversely, you can who can aid you discover the very best mix of rate and also fit.

Independent representatives benefit several insurer and can compare among them, while restricted representatives benefit just one insurance policy company. Offered the various score methodologies as well as elements utilized by insurers, no solitary insurance coverage firm will be best for everybody. To better understand your regular vehicle insurance coverage cost, invest time comparing quotes throughout companies with your chosen approach. vehicle insurance.

Your own expenses may vary. The quickest way to discover out how much a car insurance coverage plan would certainly cost you is to utilize a quote calculator tool.

Various states likewise have different driving conditions, which can affect the cost of auto insurance coverage. To give you some suggestion of what drivers in each state invest each year on cars and truck insurance, the table listed below shows the ordinary cost of auto insurance by state, according to the 2021 NAIC Vehicle Insurance Coverage Database Report.

Bundling: Bundling your home and also car insurance coverage plans typically results in costs discounts. Paying in advance: The majority of insurance companies provide a pay-in-full discount rate.

Everything about Benefits Of Ownership - Subaru

Our technique Because customers count on us to give unbiased and precise info, we created a thorough rating system to develop our positions of the most effective car insurance policy firms. We gathered information on loads of automobile insurance coverage carriers to grade the companies on a wide variety of ranking elements. Completion result was a total rating for every provider, with the insurance firms that racked up one of the most points topping the list.

low-cost auto insurance credit score insurance perks

low-cost auto insurance credit score insurance perks

Accessibility: Auto insurance coverage business with higher state availability and also few qualification demands scored greatest in this classification. accident. Price: Average auto insurance coverage prices and also discount rate opportunities were both taken into factor to consider.

, take into consideration shopping around and also obtaining quotes from competing companies. Every year or two it most likely makes sense to obtain quotes from other companies, just in case there is a reduced rate out there.

That's since the insurance company's credit reliability ought to also be taken into consideration. Nevertheless, what good is get more info a plan if the business doesn't have the wherewithal to pay an insurance claim? To run a check on a specific insurance firm, think about looking into a site that ranks the monetary strength of insurer. The monetary toughness of your insurance coverage company is important, however what your contract covers is also essential, so make certain you understand it.

In basic, the fewer miles you drive your car annually, the lower your insurance policy rate is likely to be, so always inquire about a firm's mileage thresholds. auto. 5. Use Mass Transportation When you sign up for insurance policy, the firm will typically start with a set of questions. Among the concerns it asks may be the variety of miles you drive the insured auto each year.

The Ultimate Guide To State Auto Insurance

Learn the precise rates to guarantee the various cars you're considering before buying. 7. Rise Your Deductibles When selecting vehicle insurance coverage, you can usually pick a deductible, which is the quantity of money you would have to pay prior to insurance coverage picks up the tab in case of an accident, theft, or various other kinds of damage to the car.

cheaper cheap suvs liability

cheaper cheap suvs liability

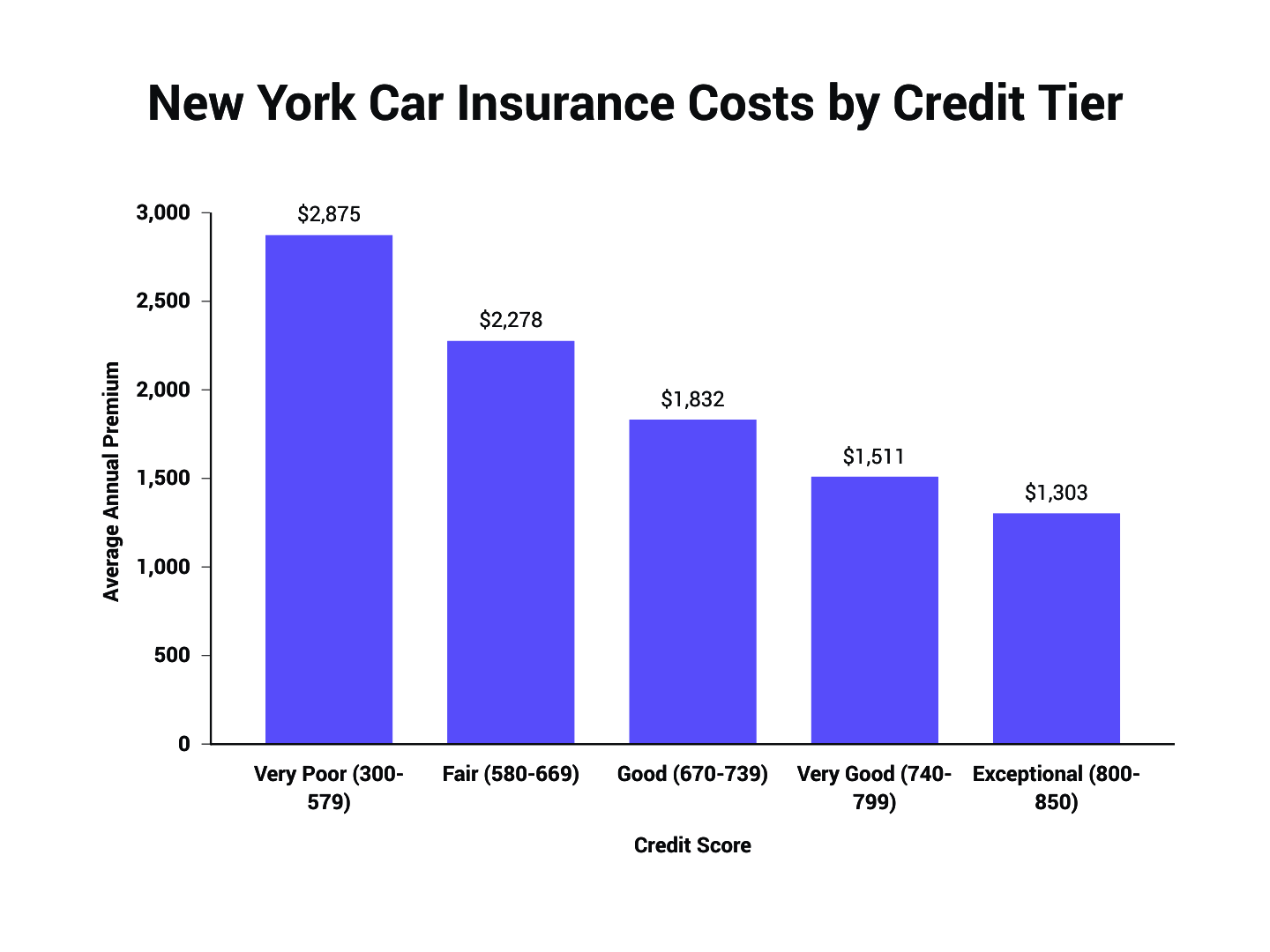

Boost Your Credit history Rating A chauffeur's record is undoubtedly a huge factor in figuring out car insurance policy costs. It makes feeling that a chauffeur that has been in a whole lot of crashes can set you back the insurance firm a great deal of cash.

It's a controversial concern in specific statehouses . cheap insurance... [] insurance companies will certainly state their studies reveal that if you're accountable in your individual life, you're less most likely to file cases." No matter whether that holds true, know that your credit history ranking can be a consider figuring insurance coverage premiums, and do your utmost to maintain it high.

4. Search for Better Cars And Truck Insurance Coverage Rates If your plan is concerning to renew and also the yearly premium has risen markedly, take into consideration searching and obtaining quotes from contending business. Also, every year or 2 it possibly makes good sense to get quotes from other companies, just in situation there is a lower price around.

What good is a plan if the business doesn't have the wherewithal to pay an insurance claim? To run a check on a certain insurer, consider checking out a website that rates the monetary stamina of insurance coverage firms.

Average Us Car Insurance Costs By State For 2022 - Kelley ... for Dummies

In general, the fewer miles you drive your car per year, the lower your insurance coverage price is most likely to be, so always inquire about a company's mileage limits (insurance company). 5. Usage Public Transportation When you register for insurance, the company will generally begin with a survey. Amongst the concerns it asks may be the variety of miles you drive the insured car annually.

Locate out the exact rates to guarantee the different lorries you're thinking about prior to making an acquisition., which is the quantity of money you would have to pay prior to insurance coverage picks up the tab in the occasion of an accident, theft, or various other kinds of damage to the car.

8. Improve Your Credit Score A motorist's document is clearly a big variable in establishing vehicle insurance prices. It makes feeling that a chauffeur that has been in a great deal of crashes could cost the insurance policy business a whole lot of cash - insure. However, folks are occasionally surprised to discover that insurance provider might also think about credit scores rankings when establishing insurance policy costs.

No matter of whether that's real, be mindful that your credit history score can be a variable in figuring insurance policy costs, and also do your utmost to keep it high.

4. Look around for Better Auto Insurance Coverage Rates If your policy will restore and the yearly premium has actually risen markedly, think about searching and obtaining quotes from completing companies. Every year or 2 it possibly makes feeling to acquire quotes from other business, simply in instance there is a reduced rate out there.

The Buzz on 10 Ways To Save Money On Your Car Insurance Bill - Motortrend

That's due to the fact that the insurance firm's credit reliability must also be taken into consideration. What good is a policy if the company does not have the wherewithal to pay an insurance case? To run an examine a particular insurer, think about taking a look at a site that rates the monetary toughness of insurance policy firms. The monetary strength of your insurance provider is necessary, yet what your contract covers is also important, so make certain you recognize it.

In general, the fewer miles you drive your vehicle per year, the reduced your insurance coverage price is most likely to be, so always ask regarding a company's mileage limits (low-cost auto insurance). Use Mass Transportation When you authorize up for insurance, the company will generally start with a questionnaire.

credit vehicle insurance perks affordable car insurance

credit vehicle insurance perks affordable car insurance

Learn the specific rates to guarantee the different automobiles you're taking into consideration before buying. 7. Rise Your Deductibles When picking automobile insurance policy, you can generally select a deductible, which is the amount of money you would certainly have to pay before insurance coverage selects up the tab in the occasion of an accident, theft, or other kinds of damage to the automobile.

8. Enhance Your Credit report Score A driver's document is clearly a large consider figuring out automobile insurance prices - affordable car insurance. Nevertheless, it makes sense that a chauffeur that has actually remained in a lot of mishaps could cost the insurance provider a great deal of cash. Folks are sometimes surprised to locate that insurance coverage companies may additionally think about credit scores ratings when figuring out insurance policy costs.

It's a controversial problem in particular statehouses (liability)... [however] insurance providers will certainly state their studies show that if you're liable in your individual life, you're less likely to file claims." Despite whether that's real, know that your credit report score can be a variable in figuring insurance premiums, and do your utmost to keep it high.

The Single Strategy To Use For Car Insurance - Auto Insurance

, take into consideration shopping around and getting quotes from contending companies. Every year or two it possibly makes sense to acquire quotes from various other business, just in case there is a lower rate out there.

What good is a policy if the company doesn't have the wherewithal to pay an insurance policy case? To run a check on a particular insurance firm, think about checking out a site that rates the monetary stamina of insurance business.

Generally, the fewer miles you drive your auto annually, the reduced your insurance price is likely to be, so constantly ask regarding a company's mileage thresholds - auto insurance. 5. Usage Public Transportation When you register for insurance policy, the company will generally begin with a survey. Among the questions it asks could be the number of miles you drive the insured automobile annually.

Learn the precise rates to insure the different cars you're taking into consideration prior to purchasing. 7. Boost Your Deductibles When picking automobile insurance policy, you can normally choose a deductible, which is the amount of cash you would need to pay before insurance policy foots the bill in the event of an accident, burglary, or various other kinds of damage to the vehicle - automobile.

8. Enhance Your Credit score Rating A vehicle driver's document is undoubtedly a huge consider identifying auto insurance coverage expenses. It makes sense that a vehicle driver that has actually been in a lot of crashes could cost the insurance coverage business a great deal of money. Folks are sometimes shocked to find that insurance policy firms might likewise take into consideration credit report scores when establishing insurance policy costs.

Not known Incorrect Statements About Average Car Insurance Costs In May 2022 - Policygenius

It's a contentious concern in specific statehouses .. - perks. [however] insurance providers will certainly claim their studies reveal that if you're liable in your personal life, you're less most likely to submit insurance claims." Regardless of whether that holds true, realize that your credit scores score can be a consider figuring insurance costs, as well as do your utmost to maintain it high.